Today's 30-year mortgage rates notch 13th day below 3.7% | Jan. 27, 2022

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Check out the mortgage rates for Jan. 27, 2022, which are trending up from yesterday. (iStock)

Based on data compiled by Credible, mortgage rates have risen across all four repayment terms since yesterday.

- 30-year fixed mortgage rates: 3.690%, up from 3.625%, +0.065

- 20-year fixed mortgage rates: 3.375%, up from 3.250%, +0.125

- 15-year fixed mortgage rates: 2.875%, up from 2.750%, +0.125

- 10-year fixed mortgage rates: 2.875%, up from 2.750%, +0.125

Rates last updated on Jan. 27, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

What this means: Mortgage rates have remained fairly stable for nearly a week, but today they’re on the rise again. Even though 30-year rates crept up slightly, they’ve been holding below 3.7% for the past 13 days. Homebuyers have an opportunity to lock in a relatively low rate now, ahead of further increases. Experts have predicted that rates could reach 4% by the end of 2022, so buyers might want to act sooner rather than later.

These rates are based on the assumptions shown here. Actual rates may vary.

To find the best mortgage rate, start by using Credible, which can show you current mortgage and refinance rates:

Browse rates from multiple lenders so you can make an informed decision about your home loan.

Credible, a personal finance marketplace, has 4,500 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

Looking at today’s mortgage refinance rates

After holding steady for the past few days, mortgage refinance rates rose across all terms today, in keeping with mortgage experts’ predictions that rates will continue rising in 2022. But there’s good news for homeowners who took out their mortgages prior to the pandemic. Mortgage rates in 2019 and before were much higher, so homeowners with older mortgages can still realize significant interest savings by refinancing into one of today’s mortgage rates. If you’re considering refinancing an existing home, check out what refinance rates look like:

- 30-year fixed-rate refinance: 3.690%, up from 3.625%, +0.065

- 20-year fixed-rate refinance: 3.375%, up from 3.250%, +0.125

- 15-year fixed-rate refinance: 2.875%, up from 2.750%, +0.125

- 10-year fixed-rate refinance: 2.875%, up from 2.750%, +0.125

Rates last updated on Jan. 27, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

A site like Credible can be a big help when you’re ready to compare mortgage refinance loans. Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Credible has earned a 4.7-star rating (out of a possible 5.0) on Trustpilot and more than 4,500 reviews from customers who have safely compared prequalified rates.

How much can I borrow for a mortgage?

It’s critical to have an idea of how much you can afford to borrow for a mortgage before you begin home shopping or make an offer on a house.

Generally, the 28/36 rule is a good measure of how much you can afford to borrow without strapping your finances. The rule states that your mortgage payment, including taxes and insurance, shouldn’t be more than 28% of your gross monthly income. And all your debts, including your mortgage and other monthly expenses like car and student loan payments, shouldn’t exceed 36% of your gross monthly income.

For example, if your gross monthly income is $6,250 (annual salary of $75,000), you should be able to afford a monthly payment of $1,750. And your total monthly debt load shouldn’t exceed $2,250.

A general rule of thumb is that you shouldn’t take out a mortgage that’s two to two and half times your gross annual income. So in the above scenario, the maximum you should borrow to buy a house would be $187,500.

Ultimately, lenders determine how much you can afford to borrow by weighing your income, debt, assets, credit and other financial factors.

Current mortgage rates

Today’s average mortgage interest rate across all terms is 3.204% — the highest it’s been since Jan. 12 when it hit 3.391%.

Current 30-year mortgage rates

The current interest rate for a 30-year fixed-rate mortgage is 3.690%. This is up from yesterday. Thirty years is the most common repayment term for mortgages because 30-year mortgages typically give you a lower monthly payment. But they also typically come with higher interest rates, meaning you’ll ultimately pay more in interest over the life of the loan.

Current 20-year mortgage rates

The current interest rate for a 20-year fixed-rate mortgage is 3.375%. This is up from yesterday. Shortening your repayment term by just 10 years can mean you’ll get a lower interest rate — and pay less in total interest over the life of the loan.

Current 15-year mortgage rates

The current interest rate for a 15-year fixed-rate mortgage is 2.875%. This is up from yesterday. Fifteen-year mortgages are the second-most-common mortgage term. A 15-year mortgage may help you get a lower rate than a 30-year term — and pay less interest over the life of the loan — while keeping monthly payments manageable.

Current 10-year mortgage rates

The current interest rate for a 10-year fixed-rate mortgage is 2.875%. This is up from yesterday. Although less common than 30-year and 15-year mortgages, a 10-year fixed-rate mortgage typically gives you lower interest rates and lifetime interest costs, but a higher monthly mortgage payment.

You can explore your mortgage options in minutes by visiting Credible to compare current rates from various lenders who offer mortgage refinancing as well as home loans. Check out Credible and get prequalified today, and take a look at today’s refinance rates through the link below.

Thousands of Trustpilot reviewers rate Credible "excellent".

Rates last updated on Jan. 27, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

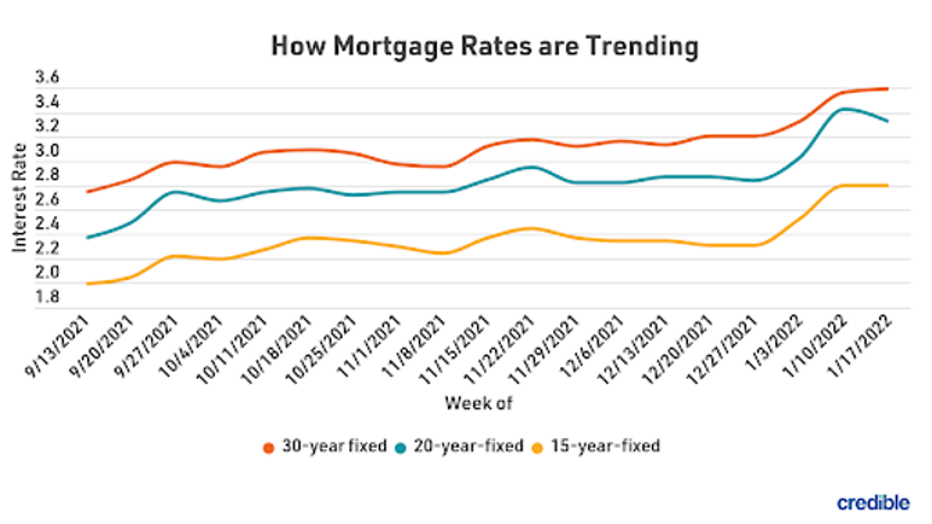

How mortgage rates have changed

Today, mortgage rates are mostly unchanged compared to this time last week.

- 30-year fixed mortgage rates: 3.690%, up from 3.625% last week, +0.065

- 20-year fixed mortgage rates: 3.375%, the same as last week

- 15-year fixed mortgage rates: 2.875%, the same as last week

- 10-year fixed mortgage rates: 2.875%, the same as last week

Rates last updated on Jan. 27, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

If you’re trying to find the right rate for your home mortgage or looking to refinance an existing home, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

With more than 4,500 reviews, Credible maintains an "excellent" Trustpilot score.

How large of a down payment do I need?

A down payment is your initial investment in your home. It’s the portion of a home’s purchase price that you’re able to pay in cash, out of your own pocket, while borrowing the balance.

You’ll typically need to have some money for a down payment when you buy a home. How much you need can vary, depending on the lender and the type of mortgage. For example, Federal Housing Administration (FHA) mortgages have minimum down payment requirements of just 3.5%. Conventional fixed-rate loans often require 5% down payments, while VA and USDA loans don’t require you to have a down payment at all.

Keep in mind that the bigger your down payment, the more likely you are to qualify for a better deal on a mortgage. If your credit is good and you can put down 20% or more, you may be able to qualify for a very good interest rate. Plus, sellers often prefer buyers with higher down payments.

Finally, a 20% down payment will typically mean your lender won’t require private mortgage insurance. PMI protects the lender if you default on the loan, and it increases your monthly mortgage payment. The cost of PMI can vary widely, but it’s typically based on a percentage of your home’s purchase price.

Looking to lower your home insurance rate?

A home insurance policy can help cover unexpected costs you may incur during homeownership, such as structural damage and destruction or stolen personal property. Coverage can vary widely among insurers so it’s wise to shop around and compare policy quotes.

Credible has a partnership with a home insurance broker. You can compare free home insurance quotes through Credible's partner here. It's fast, easy and the whole process can be completed entirely online.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.